How I write updates for our investors, board, and team

Building a rhythm of reporting is the heartbeat of the CEO role - here's what I do.

Hello! This is the second (proper) post in the Deliberate CEO newsletter. If you missed my first newsletter about how I write and communicate the Lingumi company strategy, that’s here. If you’re a post-seed startup CEO and want to be included in a peer Telegram group that I’m setting up, email me.

I’d love to hear feedback on this post, or any commentary on how you do any of this reporting, or think it could be improved. Just click ‘reply’ if reading by email, or tweet me.

—

There is surprisingly little written material by startup CEOs on the nitty-gritty of investor updates, so I thought I’d share my approach at Lingumi, and add something about team and board updates while I’m at it. I get asked most often about investor updates (‘what? When? How often? How much detail?’) but I’ll cover all three, because they feel like the horses on the CEO reporting troika: all three are needed to keep the carriage moving fast and straight.

This topic is not one I hear discussed much by startup founders, but investors sometimes give me horror stories of early-stage founders not sending a single update for 6 months. At times when Lingumi has been in a tough spot or experienced a cash crunch, I think the consistency of communications about the good, bad, and ugly is what has given our investors the confidence to support/bridge/inject some cash when we needed it.

Most importantly, writing team and investor updates is incredibly low-hanging fruit for a CEO: they’re reasonably time-consuming (and for me, still very manual), but not at all difficult to do. Building a great product, or a company, or an electric car is difficult. Writing a short email about it is not. It’s table stakes.

The good news is there’s nothing clever or innovative about them, and I follow templates for all of them, so I feel I have no excuses. If you want to do something similar, just use the links below, put in some calendar reminders, and begin doing it.

My structure is:

Every Monday morning, I send a whole-team KPI email with an update on our key metrics, and a brief paragraph of updates/inspiration/celebration/hype.

Every month, I write an investor update to all of our shareholders (yes, even the tiny angels) on the previous month.

Every quarter, I prepare a board pack for the board meeting and send it out a week ahead of the meeting.

Nothing innovative or special. All standard practice, following templates that I’ll share below, and yet an amazing number of early-stage CEOs tell me, looking somewhat abashed, that they do these things inconsistently, or not at all. So, I hope this is useful.

Weekly Team KPI Updates

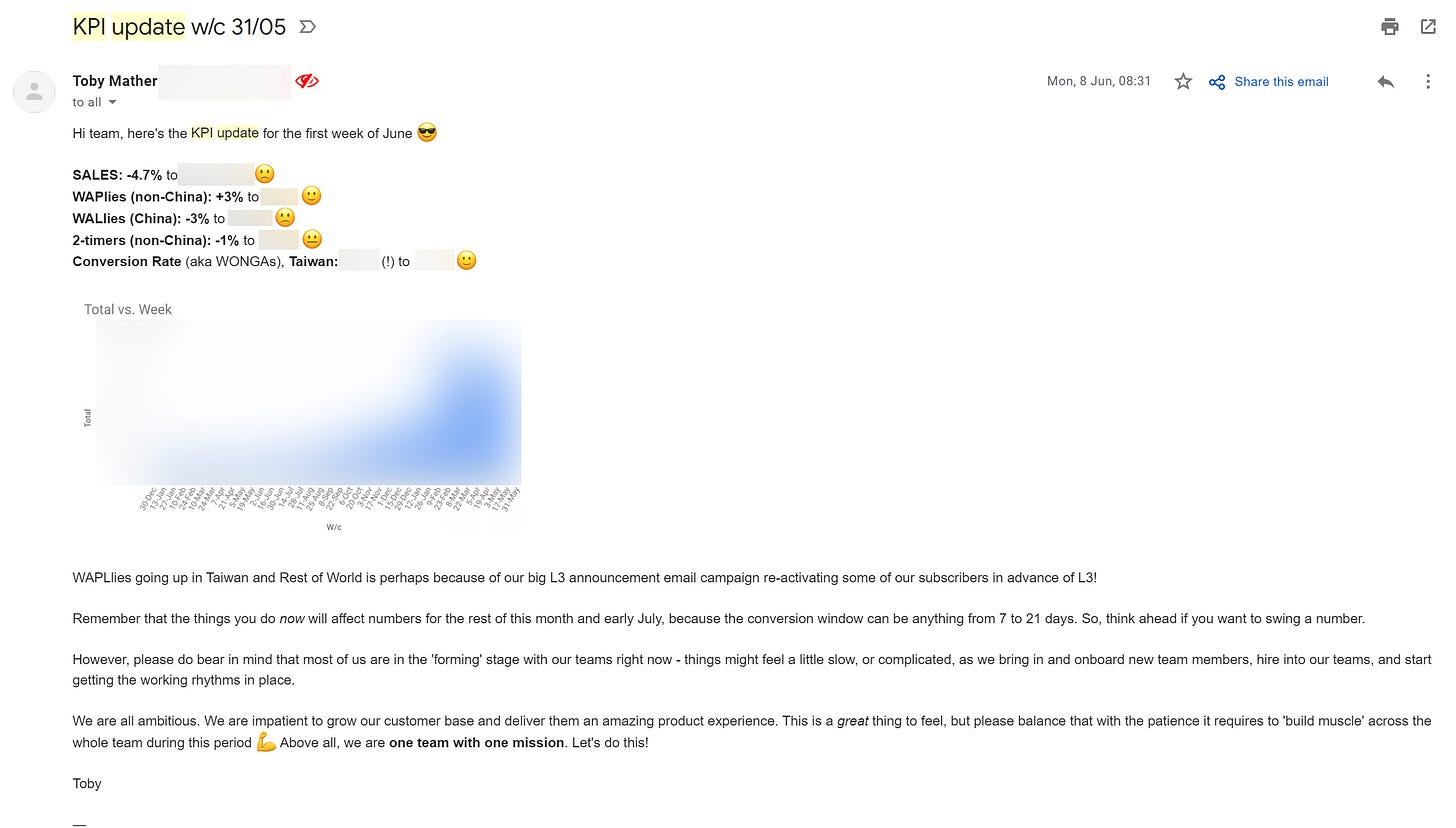

This seems to be something many CEOs do regularly. My approach was borrowed from Mathilde Colin’s advice on founder discipline. I include a ‘temperature check’ of 5-6 company KPIs (including our sales, activation rates for new users, conversion to paid and some Lingumi-specific metrics), a graph of our weekly sales (sometimes showing them against projections, to inspire the team and remind them of the huge challenge).

Growth weeks are fun. You post the ‘x metric +3%’, show the graph, and everyone is psyched up and ready for a new week. I love those weeks when the sales numbers come in and look rosy.

The tougher weeks for me are when things have been flat or down for a few weeks or months in a row. This is an opportunity to pull the team together in an all-hands and show them the numbers, and get them comfortable with the fact that growth isn’t usually exponential, even when it looks like it is (<— watch this whole talk if you have time).

Here’s a gently redacted KPI update for the end of May 2020 - an example of a ‘down week’ during a period of rapid team growth where my priority was to remind everyone that as the team grew, things might slow down, rather than speed up, and aligning around the mission as a single team was critical:

Your level of transparency is up to you. As the company grows, no doubt this changes. We’re approaching 50 people and are entirely transparent with all operating metrics at the moment, because they help the team make decisions and align around the route we’re taking up the mountain. I’m a bit sceptical of companies where sales/revenue/an overall sense of burn are not shared, because I fear that a culture of lower transparency might lead to poorer governance or lower team alignment.

One more note here: I think it’s critical that team updates are weekly, not monthly - at least in some form. This update will be your internal operating heartbeat. If the internal heartbeat is too slow, everything else will move at that same slow beat. Your team’s ability to move fast, and your senior team’s ability to reflect on and challenge the strategy swiftly when needed, depends on maintaining this high, but healthy, heartbeat. It takes about 30-45 mins to write, with some very manual data assembly, and so it feels like a faff early on a Monday or late on a Sunday, but I, and the team, appreciate it.

Monthly Investor Updates

Since we raised our first investment round in mid-2016, I’ve been writing a monthly update to all of our investors about what’s been going on at Lingumi. I have definitely missed a couple of months, which I regret, but I think I’m >90% monthly update send rates. They usually go out by the 5th day of the subsequent month.

Part of the value here is making investors feel involved and in the loop on the product and team. Part of it is getting them excited about the company so they tell their investor friends in advance of the next round (😏). But the biggest and most overlooked part of it is a sense of a fiduciary duty. By taking someone’s investment, startup founders are not just taking on a specific fiduciary duty to try to return that investment (many times over, ideally), but also a broader one to communicate about how that capital is being deployed, and how it’s ‘performing’. Your updates are the best way to do this.

I use this template from Hampus Jakobsson, including sections for summary, metrics, highlights, lowlights, team, product, and help. I also keep a google doc linked in my bookmarks bar during the month to note down anything I want to share that month. I include some analysis of the strategy at the top or bottom to try to give context to the numbers, and, as far as possible, am honest with this analysis rather than using it to cushion the truth. Finally, because Lingumi’s mission is to bring the world’s best teaching experience to the pre-school children around the world through technology, I share a cute customer video of the impact we’re making. That’s the most fun bit.

The update takes about an hour to write, sometimes two. It’s a very small investment of time into my own ‘practice’ as CEO, gives space for reflection, and keeps me honest.

Here’s the opening section of my most recent investor update, with some numbers redacted. In this email I chose to tackle the question of ‘how should we describe Lingumi?’ at the top, after seeing a few email intros to and from investors that didn’t capture what we’re building. Don’t underestimate the importance of telling your story, vision, and one-liner to your investors and team very frequently - that shared vocabulary you develop will percolate.

The months where I missed updates were some of our lowest in terms of results and morale, as cash dwindled and we ran in the wrong direction during 2018 (instead of experimenting fast towards product-market fit, which we began to do more methodically later on). I probably told myself at the time that I was too busy trying to turn things around internally to share an update, but the reality was I felt ashamed and anxious, and didn’t want to externally communicate anything less than confidence.

This was a mistake. I failed to put my own anxiety in context. Most startups have a lot of crappy months, and your investors read those updates too. Building startups is difficult, and involves lots of flat/declining growth periods. I promised not to offer too much advice in this newsletter, but do communicate regularly with your shareholders if you’re in the seed or growth stage - it’s not just your duty to do it, but they’ll also increase their trust in you as an accountable, self-reflective, and motivated leader if you communicate those rough patches, and how the company is learning from and pushing through them. You can even open with “Wow, that was a crap month…” and you’ll probably find it quite a release! That’s what I’ll be doing more often in the rubbish months. No doubt this approach needs to change after the company reaches a certain size, to consider information rights, leakage to competitors, and so on. But for a Seed or Series A company, I encourage consistent and transparent sharing.

I often read back over previous updates to get a sense of whether the analysis I wrote in the previous updates is playing out or not. This connects to my piece on writing strategy, if you want more on that topic and didn’t get the last email. I think our investors value these sections, but haven’t heard much explicit feedback to that effect.

It’s worth noting that this is not the ‘right way’ to do updates. For a contrasting opinion, I asked Rafie Faruq, CEO of Genie AI, how he structures his updates, after hearing they were well respected amongst his investor group. Rafie’s approach is less rigid than mine, and focuses even more on using the update to get specific support from investors:

Investor updates are not "reporting". It's a way to inform your investors so they can best help you…This means being succinct; if there's no major update on sales, no need to dwell on it just to fit a structure. […] Ideally investor updates should simply be the icing on the cake that you serve your team every week. You will already have charts, tables and goals to measure progress in various departments. Don't reinvent the wheel each update - just re-use your existing measurements and metrics. This will also encourage you to run your business in a structured and data driven way .

— Rafie Faruq, CEO Genie AI

Final note on updates: in bad months, they’re met with resounding silence. Of our ~20ish investors, only 2-3 tend to reply in a ‘down month’, whereas the positive updates get many more replies. Investors love growth! Don’t worry if you’re met with silence. By leaning into and communicating the rough patches, I think I’ve been accruing and compounding trust, even when I’ve been met with “crickets” (non-native English speaker? Here’s what ‘crickets’ means in this context).

Board Packs

To bang the same drum again, I think that with board packs and meetings, consistency trumps everything else. Just do them, and do them on time. A massive part of the value of the board pack is for my own discipline and reflection as CEO. How is the strategy proving out? Do we need to pivot? Do we need to slow down burn or get raising? What are the big talking points for the business? How is the team performing?

I was terrible at doing this early on, during our early seed stage, because we didn’t have formal board meetings at all. I treated each investor checkin with our first investors, LocalGlobe, as a sales pitch - a high-pressure moment to sweep the crap under the carpet and go into full ‘reassure’ mode with no clear strategy in place for the business, nor any personal introspection about it.

If doing it all again, I’d get an external observer/board visitor from the beginning to hold us accountable to a formal quarterly meeting, just to instill this discipline. I’d also be highly transparent and ask the investors and board to push hard on ‘what’s the strategy, and is it working?’

To prep the board pack, I follow this template from Sequoia, and my approach has been shaped by a mentor of mine, Lingumi investor, and former Metaswitch CEO, John Lazar, who is quoted in the Sequoia piece:

In brief, the pack contains:

An introductory letter from me, revisiting (and linking to) old board packs, reviewing the strategy and key numbers, and outlining key issues

A set of slides giving the graphs and numbers referenced in this letter in clearer detail

(New for 2020!) A matching set of 2-pagers from each of the department heads, on how their department is faring, with opportunities, challenges, and KPIs

Things that work well:

Revisiting old board packs (partly for my own benefit and introspection before writing the new one), and reflecting on progress across them

Adding nice big graphs to the accompanying slides, as these serve as visual references during the meeting (especially over Zoom screenshares - make ‘em big and clear!)

Sending the board pack a week ahead. If and when I fail to do this, it’s just inconsiderate to the board’s time, and poor personal time-keeping

Things I’ve been given constructive criticism about:

Keeping metrics consistent between meetings (if it’s ‘new users active in month 4’, keep to that, rather than swapping to ‘all users who finish onboarding active in month 4’ otherwise you lose the capacity to compare across board packs)

Being even tougher on time-keeping, and closing off debates on big topics early on for the sake of the schedule

During the meeting, my co-founder takes notes of action points and follow-ups, and I keep briefer scribbled notes of my own follow-ups, or topics I shut down that I need to revisit ‘offline’ with the member in question.

I normally allocate about 8 hours to board pack prep, but currently find it takes about 12 hours to gather the data, review old packs, write the letter, assemble the slides. This is a time for deep thought, and is certainly not wasted, so next quarter I’ll block out my calendar even more ruthlessly for it. I begin prep 2 weeks ahead in order to send the pack a week ahead, and block most of the day prior to sending the pack just to finish prepping it.

I am tempted by the idea in the Sequoia piece to sketch out a board pack plan for an hour after finishing each board meeting, while topics are top of mind. If I try that, I’ll report back!

—

So, there’s a fairly complete run-down. I’d really like to hear feedback from CEOs at a similar stage: hit reply or send me an email (first name at domain name dot com) if you feel your process is better, or just a robust alternative, and would be happy to share it. If you’re really struggling with any of this, feel free to contact me, too - I’ve suffered in silence a lot while trying to figure out how to do some of it. I hope sharing it helps.

Toby